Earning a raise at work may mean that your client will be able to get that new dream car or make those extra house repairs, but it may also mean it’s time to rethink their financial plan.

As counterintuitive as it seems, our research found that getting a raise can actually make it more difficult for investors to retire comfortably.

Here’s a closer look at why that happens and what you can do about it.

Why can increased income backfire?

Getting a raise means an individual’s expenses will increase: First, the higher income will be used to pay for an extra latte to get through the midweek blues; then an extra trip to the spa; then a car upgrade. This phenomenon is known as lifestyle creep, a gradual increase to an individual’s standard of living.

This effect can put someone’s retirement plans at risk because existing savings and other common retirement assets are relatively fixed. And, contrary to our best intentions, many people don’t actually increase their savings rate when they get a raise.

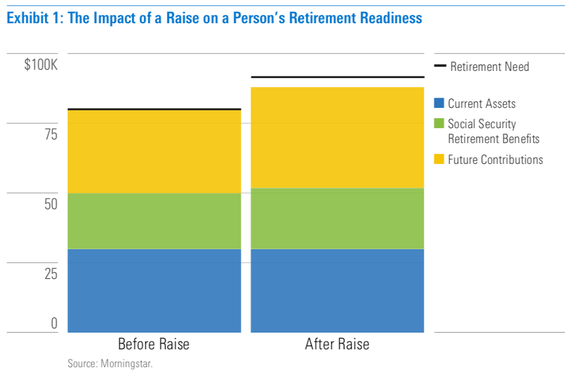

The chart below shows how retirement assets can be quickly outpaced by retirement needs when someone gets a raise, assuming that person’s salary goes from $100,000 to $120,000 at age 47 and a constant 11% of their salary is saved. After getting a raise, many people adopt a higher standard of living they feel they’ll need to match in retirement, and they don’t commit the necessary funds to reach this new goal. Controlling lifestyle creep can help get your clients back on the right track.

How much of a raise should be saved?

Using data from the 2016 Survey of Consumer Finances, we created a model to determine how much of a 5% raise a person should save so that their retirement can reflect their recent lifestyle change.

Our results suggest two main points:

- Save more, no matter what. Everyone should save more every time they get a raise. How much more depends on the investor’s personal characteristics, such as their age, existing retirement savings, and income.

- Prioritize the timeline to retirement. Because older households have less time left until retirement, they have less time to accumulate sufficient savings and less time in the market to generate returns. Despite how much they already have saved, older households should save more to keep up with their new standard of living after getting a raise.

Rules to be better about controlling lifestyle creep

Using our model, we analyzed a few potential rules of thumb investors can follow to figure out how much of their raise to save. The three rules we tested were:

- Spend twice your years to retirement. If you are going to retire in 10 years, you should spend 20% of your raise and save the remaining 80% for retirement.

- Save your age, as a percentage of the raise. If you are 50 years old, you should save 50% of the raise.

- Save at least 33% of your raise. If your take-home income increased by $1,000, you should save $333 of that new income.

The chart below shows the effectiveness of each rule. The “spend twice your years to retirement” rule has the highest success rate across age groups, but it also requires the most savings. For younger investors, “save your age” is a good alternative until around age 45 and may not require as intensive of a saving goal.

Although these three rules are good starting points for saving techniques, each investor is different and can benefit from a plan that incorporates their personal characteristics and needs. This is a great opportunity for advisors to give personalized advice to their clients.

Don’t get stuck in a raise

When getting a raise, many investors’ first reaction is to celebrate and not think of the consequences. However, there are a few things investors and advisors must consider when a client’s income increases, such as its impact on their retirement plan and controlling lifestyle creep.

Our research showed that most investors, despite their existing retirement assets, must save more after getting a raise. Although we found some success using a few rules of thumb, consulting an advisor for personalized advice is the most effective way to find out how much more to save.