3 min read

39 Charts That Track Market Data for Financial Advisors

Monitor the equities, fixed-income, and funds markets.

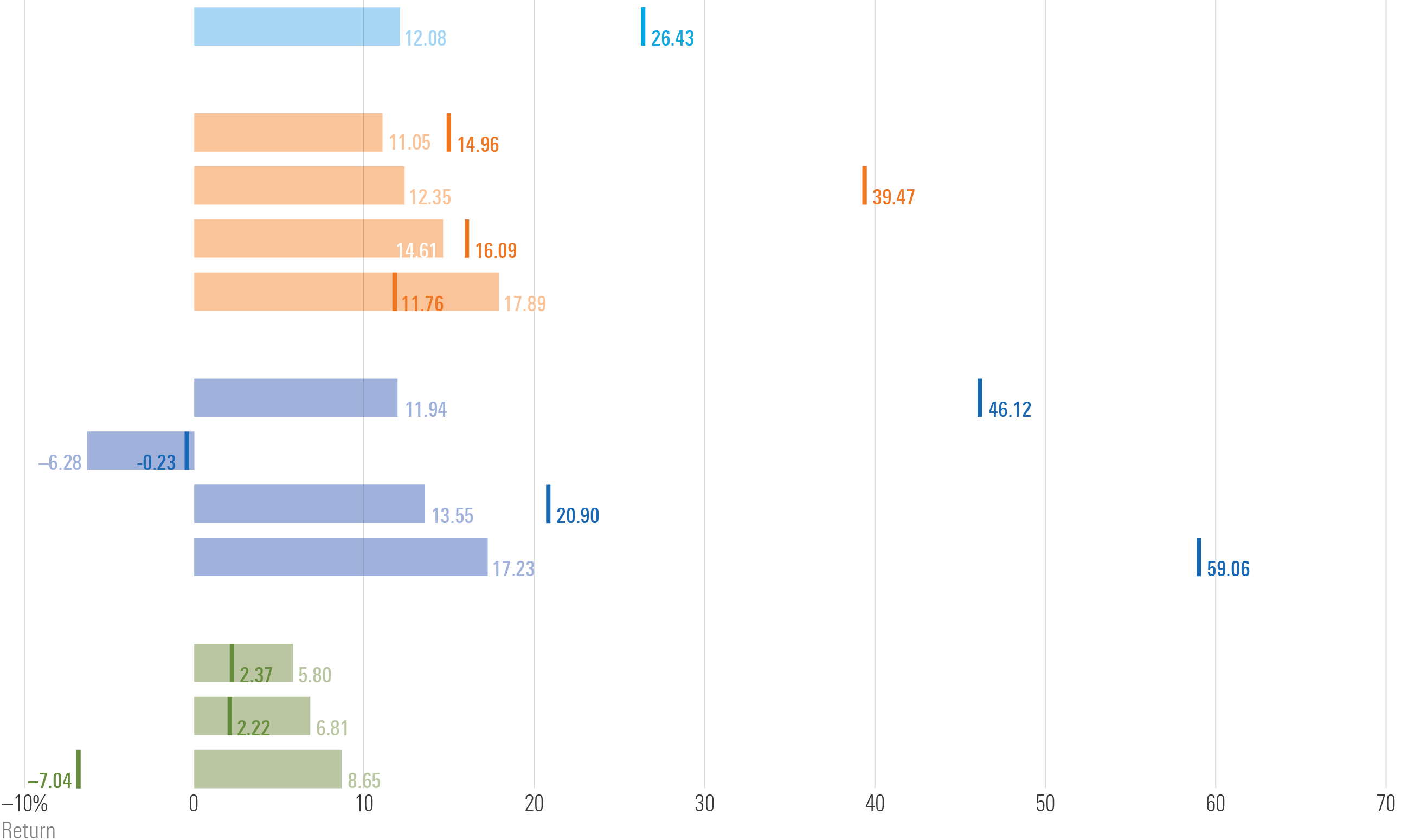

Equities Market

U.S. equity sector performance

Cyclical and sensitive stocks outperformed their defensive counterparts in the fourth quarter of 2023.

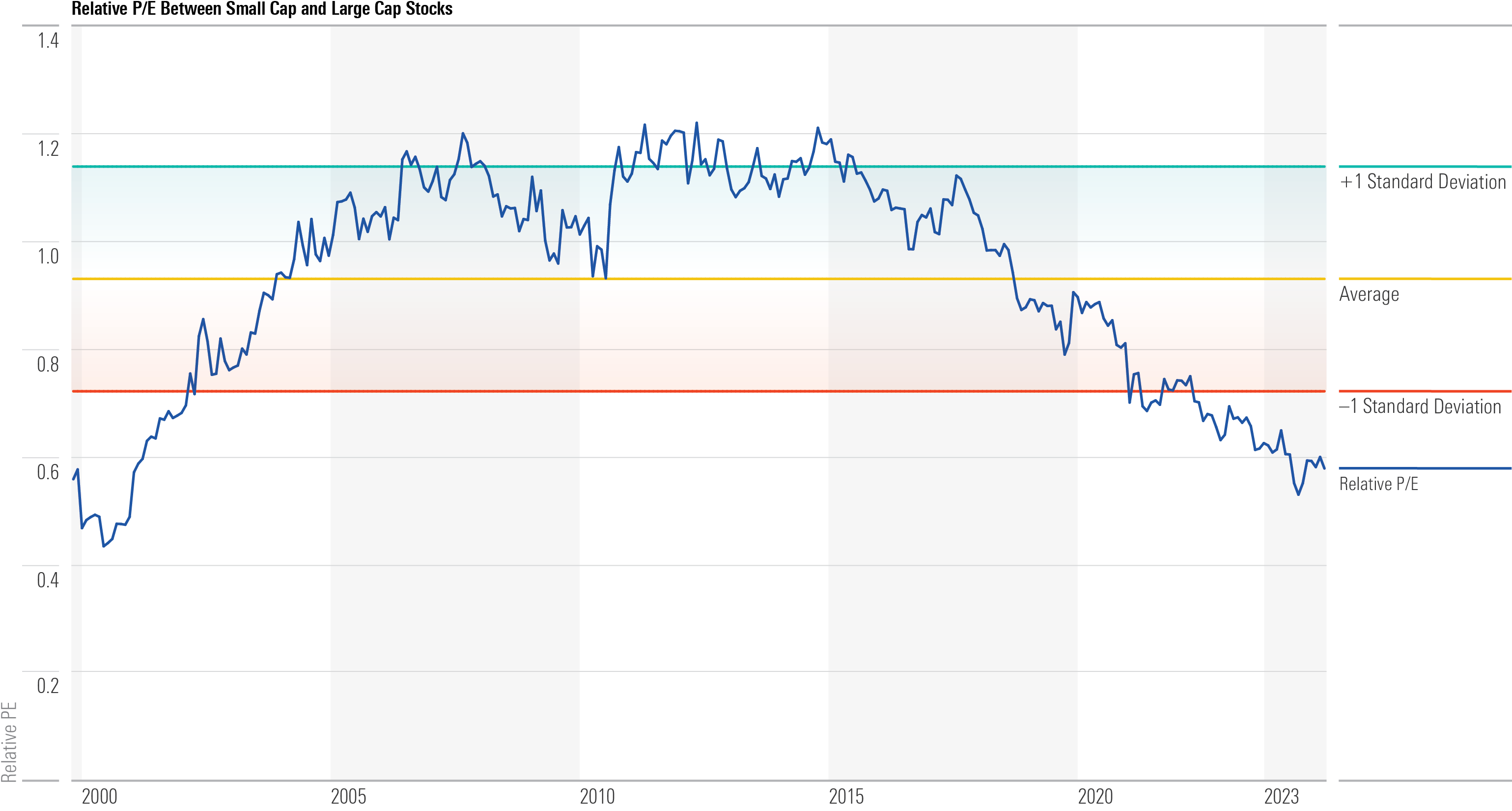

U.S. small-cap stocks look inexpensive

Our analysis suggests that small-cap stocks may be undervalued, compared to large-cap U.S. equities.

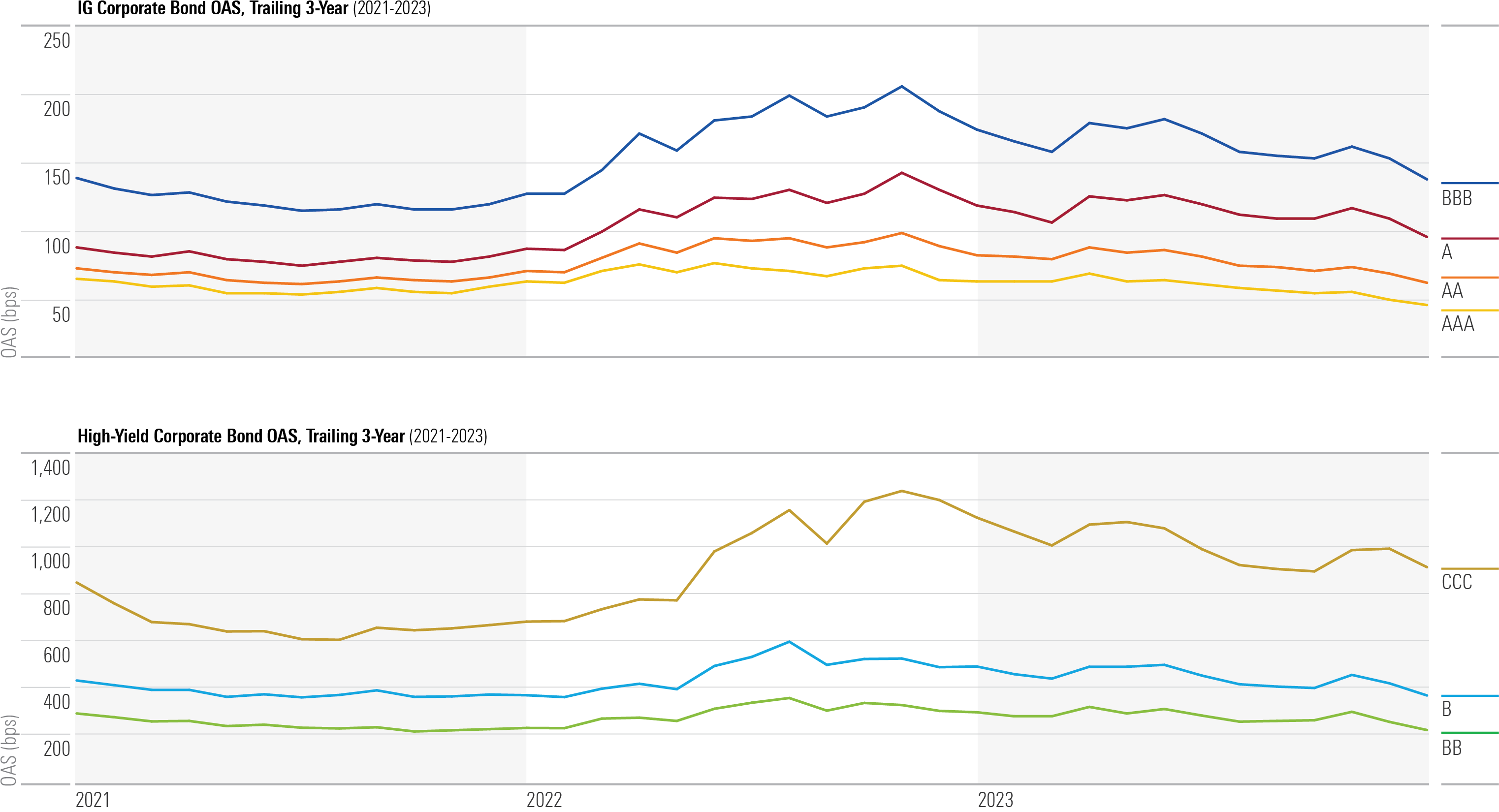

Fixed-Income Market

Credit spreads tighten in 2023

Credit spreads of corporate bonds over the trailing three years. Widening credit spreads indicate that lower-quality securities are becoming riskier compared to higher-quality bonds.

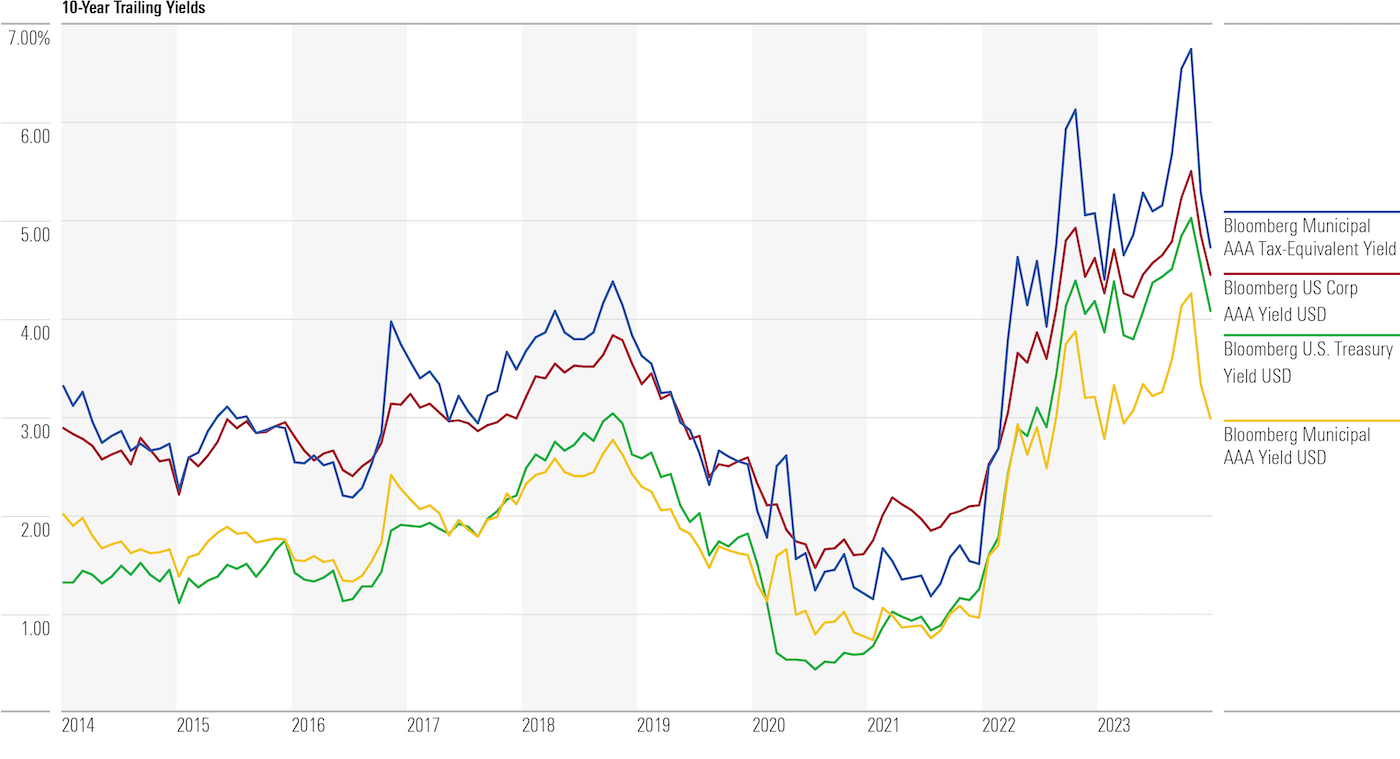

Municipal bonds and tax-free income

Ten-year trailing yields of different types of bonds.

Economic Indicators

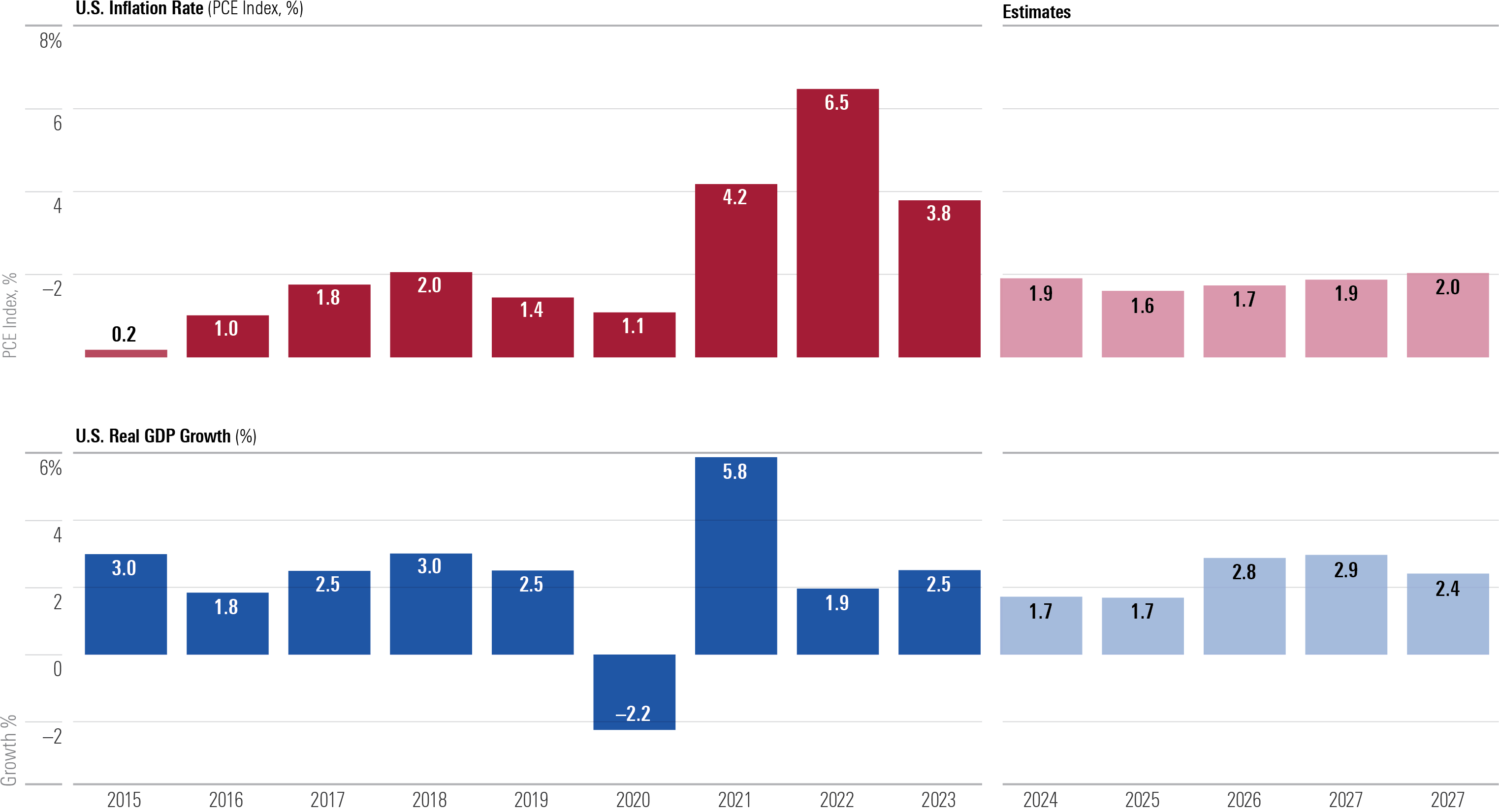

Slowing GDP growth

We predict U.S. GDP growth will trough in 2024 before recovering.

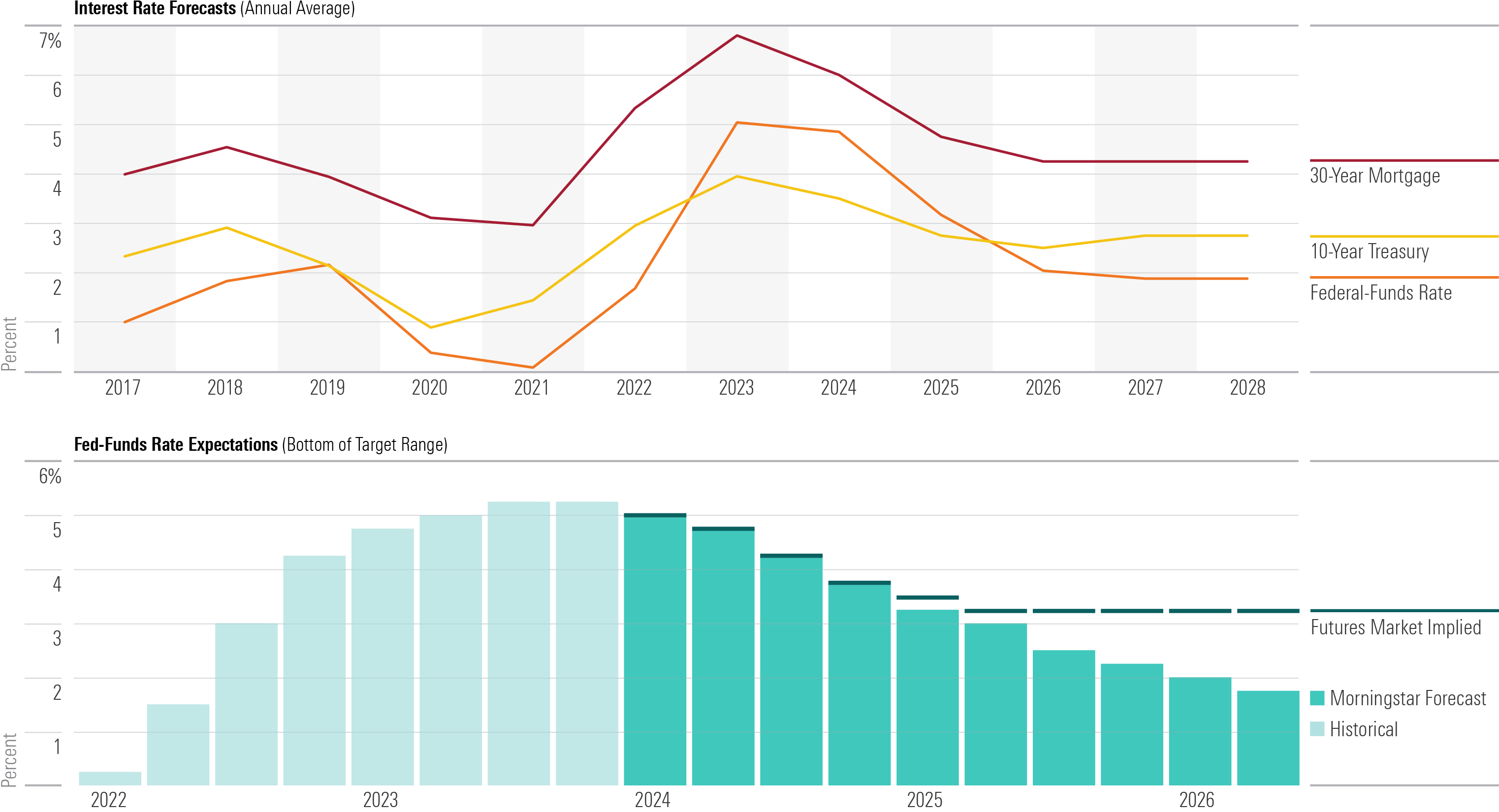

U.S. interest-rate projections

We project U.S. interest rates to fall lower than the market expects.