5 min read

Understanding Semiliquid Funds: How Morningstar’s Rating System Helps to Guide Investment Decisions

The Morningstar Medalist rating for semi-liquid funds serves as a valuable tool for investors and advisors that assists in determining suitability for portfolio inclusion and selecting optimal options

Welcome to the dynamic world of semi-liquid funds, where investment meets innovation! In a recent webinar, we unveiled our groundbreaking Morningstar Medalist rating for semi-liquid funds. This exciting extension of Morningstar's proven methodology brings a new level of clarity and confidence to retail and professional investors and advisors navigating the complex terrains of private equity and credit spaces.

Get ready to explore how this rating system is set up to revolutionize the way we assess and choose the best funds for a diversified and robust portfolio. From understanding what makes a fund "semi-liquid" and the importance of independent ratings to learning how semiliquid funds can provide access to investment opportunities in less-available private markets, we've got you covered with all the essential knowledge you'll need.

Semiliquid funds: understanding the Morningstar Medalist Rating

The recent webinar introduced an innovative extension of the Morningstar Medalist rating, specifically designed for semi-liquid funds. Historically applied to mutual funds, ETFs, and managed portfolios, this rating methodology now evaluates semi-liquid funds commonly found within private equity and private credit spaces. Assigning ratings of gold, silver, bronze, neutral, or negative, this system guides investors and advisors in determining the suitability of semi-liquid funds for their portfolios, providing a comprehensive overview of available options.

What is a semiliquid fund?

A semiliquid fund represents a long-term investment vehicle in the United States, where many interval funds allow investors to redeem up to 5% of assets per quarter. Qualifying funds include interval funds, tender-offer funds, non-listed Business Development Corporations (BDCs), and non-listed Real Estate Investment Trusts (REITs). These funds typically constrain liquidity structurally, making them evergreen or perpetually offered, which is the vehicle Morningstar rates.

Why are we rating semiliquid funds?

The Morningstar Medalist rating for semi-liquid funds serves as a valuable tool for investors and advisors that assists in determining suitability for portfolio inclusion and selecting optimal options. It considers fund purpose, expectations, and key aspects to look for in semiliquid funds. Morningstar currently tracks approximately 500 US-domiciled semi-liquid funds, acting as access points to private assets for retail investors.

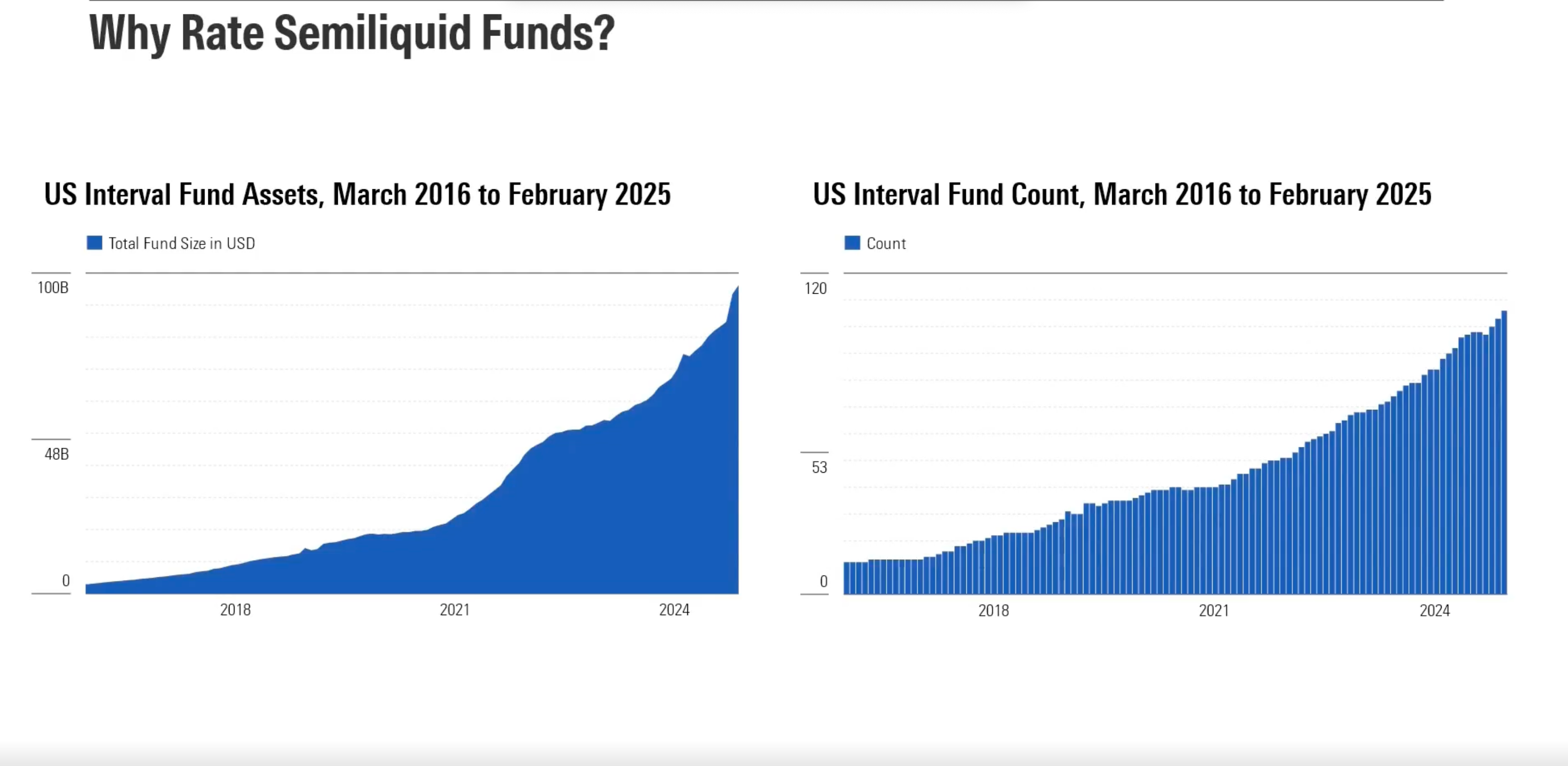

The volume of US interval fund assets and US interval funds has steadily and dramatically increased between March 2016 and February 2025. Source: Morningstar, February 2025.

Wealth managers aim to build more diversified and liquid portfolios for clients while effectively managing liquidity. As wealth managers increasingly incorporate these funds into client profiles despite their higher fees, asset managers seek exposure to private markets on a larger scale to enhance their assets under management (AUM) and expand offerings.

The rating process offers independent research and insights into the semi-liquid funds landscape, traditionally characterized by higher fees and constrained liquidity. This information is crucial for advisors and investors to assess fund suitability for client portfolios.

Steps to formulate a semiliquid fund rating in Morningstar:

- Compute a weighted score from analyst-rated Process (50%), People (25%), and Parent Pillars (25%).

- Systematically adjust the score using fee ranks.

- Assign the Medalist rating using a rules-based table, allowing for committee discretion when necessary.

What are people asking about semiliquid funds?

Do you have questions about semiliquid funds in Morningstar Direct? You’re not alone! Here’s what others have been wondering and what we have to say in reply.

Questions about semiliquid vs traditional investments

How should clients think about the trade-off of semi-liquid vs traditional drawdown?

Clients should consider the trade-off in terms of liquidity constraints, higher fees, and less transparency associated with semi-liquid funds compared to traditional investments. The expectation is that semi-liquid funds should outperform public market equivalents or broad private benchmarks to justify these trade-offs.

Will there be information sharing between Pitchbook and Morningstar to have flow-through data to have both Semi-liquid and Traditional Drawdown structures all in a single place to help with Portfolio construction?

Yes, there is a collaboration between PitchBook and Morningstar to bring together data from both platforms, allowing for a comprehensive view of semi-liquid and traditional drawdown structures.

Questions about Fund Ratings and Methodology

How are you selecting the funds to be covered? Are you partnering with any alternative investment platforms like CAIS or iCapital?

The selection process involves tracking funds available in the market, but there is no mention of partnerships with platforms like CAIS or iCapital.

Can you share more color on how you will determine which strategies in the universe the team plans to evaluate?

The team plans to evaluate strategies based on their relevance and availability in the market, focusing initially on interval funds and expanding to other semi-liquid vehicles.

What is the initial process to kick off getting your Fund Rated? Is that driven by Morningstar? Or does the Manager have to reach out to you first?

Managers can suggest strategies to be rated through a link provided in the webinar materials, indicating that both Morningstar and managers can initiate the rating process.

Do you require a track record for an interval fund to be rated? Is it 3 years at a minimum?

No, there is no minimum track record requirement for rating interval funds. It's nice to have a longer track record, but there's definitely a mix of reasons as to why something is covered.

Is there a minimum performance history required to get a rating?

No, there is no minimum performance history requirement to get a rating.

Is it correct that all the funds will be rated by the analyst and not by the quant model?

Yes, the funds will be rated by analysts, not by a quant model.

Questions about Parent Pillar and Manager Focus

For the Parent pillar, do you focus on the manager (sub-advisor) managing the strategy or the Advisor/Parent?

The focus is on the broader resources and capabilities of the parent firm, including governance processes and the ability to facilitate robust teams.

Given that the Parent weighting has increased, do you intend to place more emphasis on the fund's sub-adviser, which could, in many cases, be different from the fund's adviser?

The increased weighting on the Parent pillar reflects the importance of the firm's overall capabilities rather than individual sub-advisers.

Questions about Tender Offer Funds and Interval Funds

Are tender offer funds included in the Interval fund universe? Are you also covering tender offer funds?

Yes, tender offer funds are included in the semi-liquid universe and are covered.

Questions about Data Availability and Accessibility

Will this database and these ratings be available in Morningstar Direct? If yes, then when is the ETA and how many funds will initially be covered/ranked?

Yes, the database and ratings will be available in Morningstar Direct. The initial coverage includes about 143 interval funds, with plans to expand coverage.

Questions about Fees and Incentive Structures

Will you be adding any data points that are relevant to these funds, in particular Interval Funds? Examples include Performance incentive fee terms, Redemption windows and amounts, Leverage amounts, % illiquid assets.

Yes, relevant data points such as performance incentive fee terms and redemption windows will be included.

Why do you account for fees if returns are NET of fees? That seems like double counting.

Fees are accounted for to adjust fund scores, as they impact the net returns and are a significant consideration for investors.

Semiliquid offerings often include incentive fees. As such, they can vary over time. How does your assessment address this difference compared to active and passive products?

The assessment uses an expected rate of return to calculate an average effective fee, allowing for comparison between funds with and without incentive fees.

Questions about Fund Categories and Coverage

Is there a plan to expand to non-US domiciled semi-liquid funds? How will you source the data for those?

Yes, there are plans to expand to non-US domiciled semi-liquid funds, with data sourced from regulatory filings and other relevant sources.

Is the universe focused on U.S. products primarily? Will there be a plan to also have Canadian coverage?

The initial focus is on U.S. products, but there are plans to expand coverage, potentially including Canadian products.

How to find the medalist rating inside Morningstar Direct

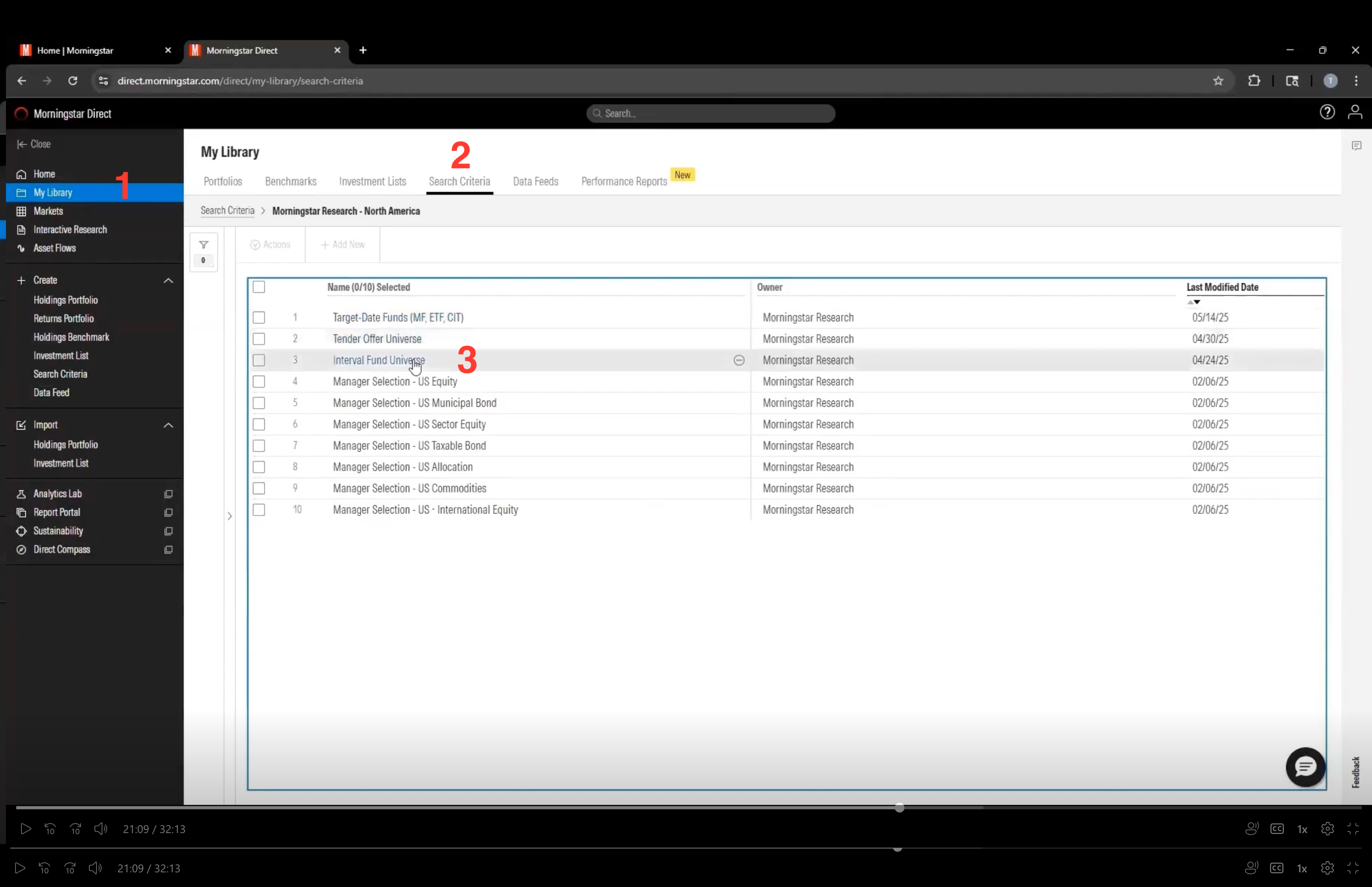

Asset and wealth managers can access the Morningstar Medalist rating within the Morningstar Direct application. By navigating to "My Library" and searching the Morningstar research folders, users can find data curated for interval funds available in the U.S. This dynamic data allows for customizable views, list creation, and report generation, with updates in real-time.

Steps to Access:

- Open Morningstar Direct.

- Navigate to "My Library."

- Search the Morningstar research folders.

- Locate interval fund universe data.

- Customize views, create lists, and generate reports.

The steps to find semiliquid fund rating information inside Morningstar Direct are simple and easy. Source: Morningstar Direct

With plans for continuous data expansion, Morningstar Direct remains a valuable tool for those navigating the semi-liquid funds landscape. Explore more by taking a tour of Direct or scheduling a two-week trial.