5 min read

How Model Portfolios are Evolving

More financial advisors are teaming up with model portfolio providers to use their models as a foundation for customization. Custom model portfolios can be adjusted to meet the specific preferences of advisors and investors. Morningstar estimates that custom model portfolio assets have grown to more than $125 billion as of Sept. 30, 2024, up almost 50% from June 30, 2023, according to Morningstar’s Guide to Customizing a Model Portfolio, released in February.

Model portfolios offered by asset managers and third-party strategists have become the backbone of many financial advisors’ practices. Outsourcing some, or all, of their investment-management responsibilities lets advisors focus on more holistic financial planning and on managing their business.

Despite the advantages of model portfolios, Morningstar’s Voice of the Advisor Market Research Program noted that 27% of advisors do not offer them. A preference for customized portfolios was by far the largest sticking point, followed by a perceived lack of control over investment decisions. Custom model portfolios provide advisors with a middle ground where they still reap the benefits of using models while retaining some discretion over investment decisions.

Custom Model Assets Are Growing

Only a few asset managers dominate the custom model portfolio arena, led by Wilshire and BlackRock. Since Morningstar’s 2023 US Model Portfolio Landscape report, the top custom model portfolio providers have all notched gains in assets. For example, Invesco’s custom model business swelled 536% to just over $8 billion, while BlackRock grew by 84% to $45 billion. But Wilshire remains the largest player, with more than $50 billion in custom model assets.

Growth of Custom Model Assets: Providers of model portfolios have seen rapid growth in a short time.

Top Providers

Other Providers

Custom Model Portfolios: What They Are and How They Work

Custom model portfolios are developed by modifying an off-the-shelf provider’s portfolio to accommodate an advisor’s preferences or a client’s needs. Advisors work with asset managers, using their model portfolios as starting points for customization. Custom can mean different things, but some of the most common options include fund substitutions, additional asset classes, lineup consolidation, strategic asset-allocation adjustments, and trading frequency.

For example, an advisor may want to add an index exchange-traded fund to a model composed of actively managed funds to lower fees. They could substitute an index ETF for the actively managed fund they want to replace. There are lots of ways to customize a model, but advisors should be mindful of how each modification could change the portfolio’s composition and risk profile. It’s important to think about the impact on a portfolio before implementing changes to avoid unwanted exposures or shifting the portfolio away from its objective. That’s why it may be a good idea to keep strategic asset-allocation changes to within a reasonable band, such as a 5-percentage-point loss or gain around the baseline portfolio.

If substituting funds in and out, advisors should pay attention to the asset-class and sub-assetclass allocations. For example, if they are substituting in a concentrated, actively managed growth stock fund in place of a broad stock market index fund, the portfolio’s equity sector allocation will likely shift, and it could develop a growth bias in the equity sleeve. That kind of bias is likely to change the total portfolio’s risk profile. This is another thing to keep in mind when modifying the portfolio to include riskier areas of the market like growth stocks or high-yield bonds.

The Morningstar model portfolio guide explores various scenarios of how portfolios can change, or not, through customization. One instance examined a scenario where an advisor wanted to get more income from the portfolio. That led to swapping in a flexible actively managed global bond fund for an index-tracking global bond fund and a high-yield index fund for a long-term bond fund. Those shifts, among others, added considerably more credit exposure to the portfolio. In a recessionary environment, the extra credit risk may lead to steeper drawdowns that could make it hard for the client to stick with the portfolio to reach their goals.

How to Customize Portfolio Allocation Models

Here’s what advisors need to know about creating and offering custom model portfolios for their clients.

When customizing a portfolio allocation model, advisors can focus on the following:

- Adjusting stock/bond splits: Modifying the portfolio’s stock and bond balance can address client-specific goals. For example, an advisor might tweak the split between equities and fixed income if a client sits between two risk-tolerance categories.

- Shifting underlying exposures: Advisors might make strategic changes to underlying exposures, such as tilting toward international equity or emerging markets, to take advantage of market opportunities.

- Adding asset classes: To diversify returns, advisors might introduce asset classes such as private equity, cryptocurrency, or real estate.

- Changing funds: Advisors will often swap out the asset manager’s preferred funds for their own choices.

- Trading: Advisors can allow platforms to trade on their behalf or conduct their own trades.

- Paying attention to fees: There may be an additional portfolio management fee if the asset managers’ proprietary funds fall below certain asset thresholds in the models.

Do’s and Don’ts of Customizing Asset-Allocation Models

While customization can offer benefits, advisors should approach it with a disciplined strategy.

The following do’s and don’ts can help guide advisors to make effective portfolio modifications.

Do:

- Define investment objectives and risk tolerance: Do this before making any changes. This foundational step ensures that modifications align with the investor’s long-term financial plan.

- Keep allocation adjustments within reasonable bands: Strategic asset-allocation moves should be limited to 5 or 10 percentage points around the original portfolio structure. Drastic shifts can unintentionally increase risk and deviate from the portfolio’s intended purpose.

- Evaluate portfolio impact before implementing changes: Advisors should assess every adjustment—whether a fund substitution or a strategic reallocation—for its impact on total costs, risk, liquidity, and overall portfolio exposure. Changes might have unintended consequences.

- Take the hypothetical example of a client who prefers actively managed mutual funds for some asset classes—such as large-cap growth and small-cap equities—and passive management for others, such as large-cap core equity and core bond funds. How would changes to passive exposure affect a portfolio?

In one of the six case studies in the Morningstar guide, researchers swapped out active large-cap equity funds from one model in favor of index-tracking exchange-traded funds. The team used Morningstar Direct to assess the impact of this change. The data showed that the change reduced the portfolio’s average expense ratio without dramatically altering its risk profile. But while cheaper and slimmer, the new portfolio had more rigid geographic exposures. Unlike the previous active fund, where managers had the flexibility to invest beyond their benchmark, the new fund—a global stock index ETF—tilted heavily toward US stocks.

While US stocks have dominated for much of the past decade, this new custom portfolio may miss out if international stock markets take the lead.

This change reduced expense ratios without dramatically shifting the portfolio’s composition. Strategic alignment with the client’s moderate risk preferences made this customization impactful and successful, exemplifying smart portfolio tuning.

Don’t:

- Customize model portfolios for the sake of it: Advisors should resist the temptation to tweak portfolios purely to feel in control over investment decisions. Unnecessary modifications can lead to increased complexity and unintended risk exposure that negate the benefits of using a model portfolio. Advisors should aim for simplicity, ensuring that modifications enhance rather than undermine the portfolio’s strategic intent.

- Shift allocations beyond the investor’s risk capacity: Adjustments shouldn’t push the portfolio so far from the original model that the portfolio’s risk profile no longer fits the investor’s objectives and risk tolerance. Overweighting volatile sectors subject to major market fluctuations can lead to misalignment with the investor’s financial goals.

- Substitute a drastically different fund from a model’s recommended strategy: It could dramatically change exposures.

- Add volatile assets solely based on performance: Tempting as it may be to add cryptocurrencies like bitcoin after they outperform the market, such assets come with extreme volatility. Even a small allocation to an asset class like crypto can have outsize effects on a portfolio’s risk profile. Before adding crypto or another emerging asset class, advisors should review any trade-offs with clients. Risk profiling and risk scoring tools can show clients how potential changes line up with their risk tolerance.

- Make so many changes to the model that it negates the point of choosing a model in the first place.

Our Top Picks for Allocation Model Portfolios

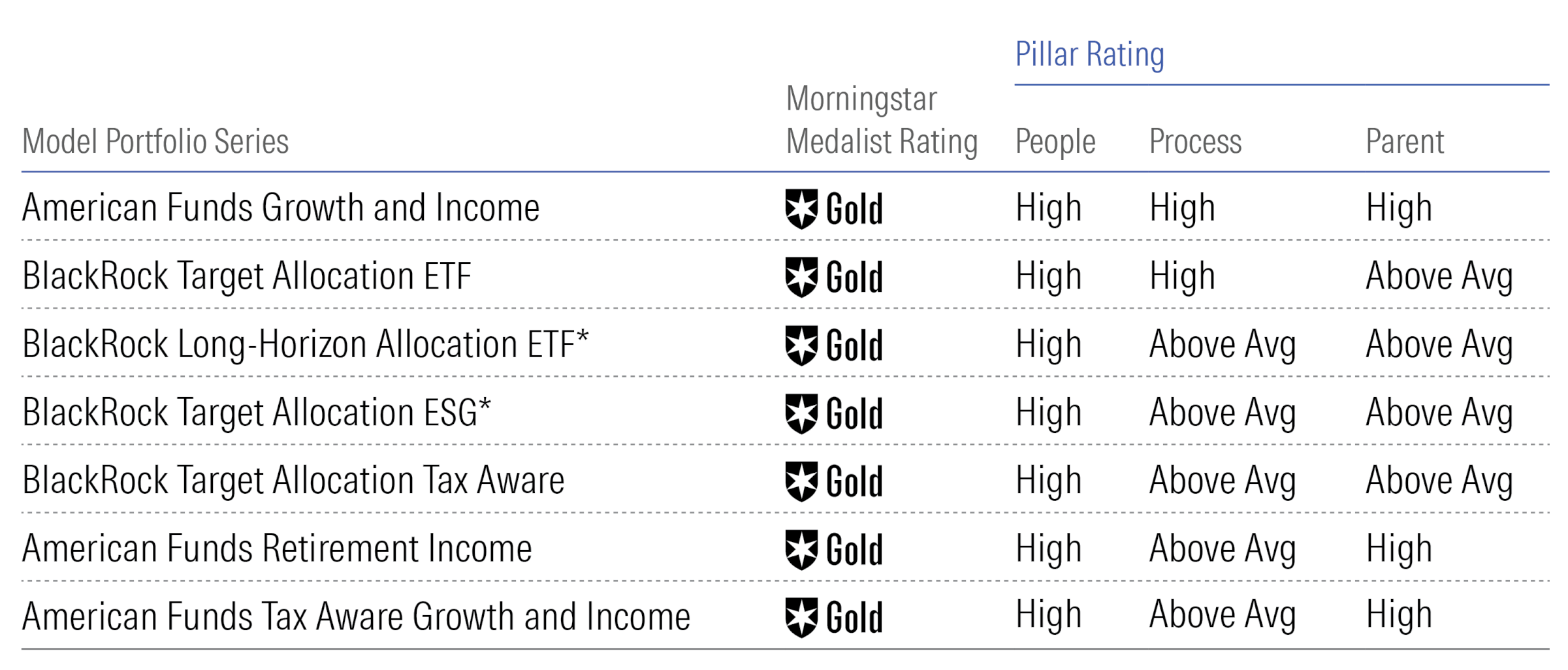

Advisors seeking robust model portfolios can consider these highly rated options as starting points to customize. The Morningstar Medalist Rating offers a forward-looking, qualitative rating assigned by Morningstar analysts. The highest ratings go to strategies that analysts conclude will outperform their Morningstar Category benchmarks over a full market cycle on a risk-adjusted basis net of fees.

Gold Rated Portfolios

These seven model portfolio series earn Morningstar analysts’ top rating.

* Morningstar analysts rate the separate account offering only. Source: Morningstar Direct. Model portfolio series under analyst coverage as of Dec. 31, 2024. Medalist Ratings as of Dec. 31, 2024.

Morningstar analysts awarded seven model portfolio series with a Medalist Rating of Gold. The full list of medal-earning model portfolios is available in the custom model portfolios guide.

Stephen Margaria is a manager research analyst, multi-asset and alternative strategies, at Morningstar Research Services LLC.

This article originally appeared in Morningstar Magazine, 2025 Q2 Edition.

The portfolios in Morningstar’s Guide to Customizing a Model Portfolio use off-the-shelf models reported to Morningstar as a starting point and are for illustrative, educational, or informational purposes only. This information should not be relied upon as investment advice, research, or a recommendation by Morningstar. Only an investor and their financial professional know enough about their circumstances to make an investment decision.