6 min read

The State of Diversity in Asset Management

How does a diverse workforce impact investment outcomes?

.png?format=webp&auto=webp&disable=upscale)

Key Takeaways

White men and women comprise 76% of executive roles in asset management, while Hispanic, Black, and other non-white professionals remain underrepresented.

Fund performance shows no clear advantage for men-only, mixed-gender, or women-only portfolio-management teams.

Gender, racial, and ethnic diversity data within asset management firms lacks transparency.

A look at racial, ethnic, and gender diversity in the workplace

Data for this section is sourced by survey from asset management firms that collectively manage nearly 60% of US-domiciled open-end and exchange-traded fund assets as of August 31, 2024. The survey collected insights on gender, racial, and ethnic diversity of whole-firm populations, senior leadership, and investment teams. It also considered firms’ engagement with industry-wide initiatives to foster diversity.

Download the full report to explore these insights.

Gender, racial, and ethnic representation

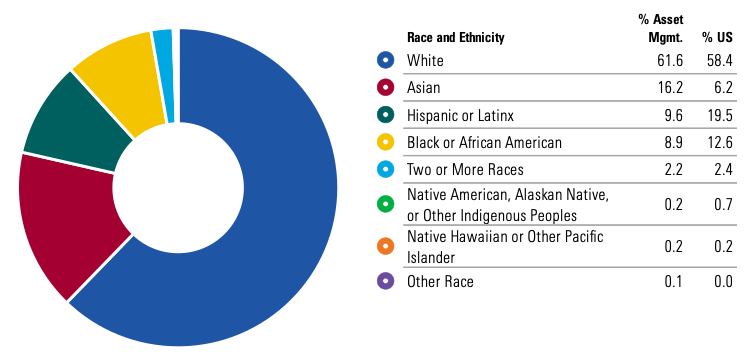

White men and white women continue to make up the largest group in the industry, together representing 62% of all asset-management professionals in the study, higher than their 58% share of the US population. Asian individuals hold 16% of roles, roughly 2.5 times their 6.2% representation in the US population.

By contrast, Hispanic and Black professionals are the third- and fourth-largest groups by race and ethnicity in asset management, but their representation in the industry is lower than in the general US population. People identifying with two or more races comprise about 2% of asset-management roles and the US population.

Women also remain underrepresented, comprising only 44% of the asset-management workforce compared with 51% of the US population. This gap widens further in senior leadership and investment-focused roles.

The impact of diversity on investment performance

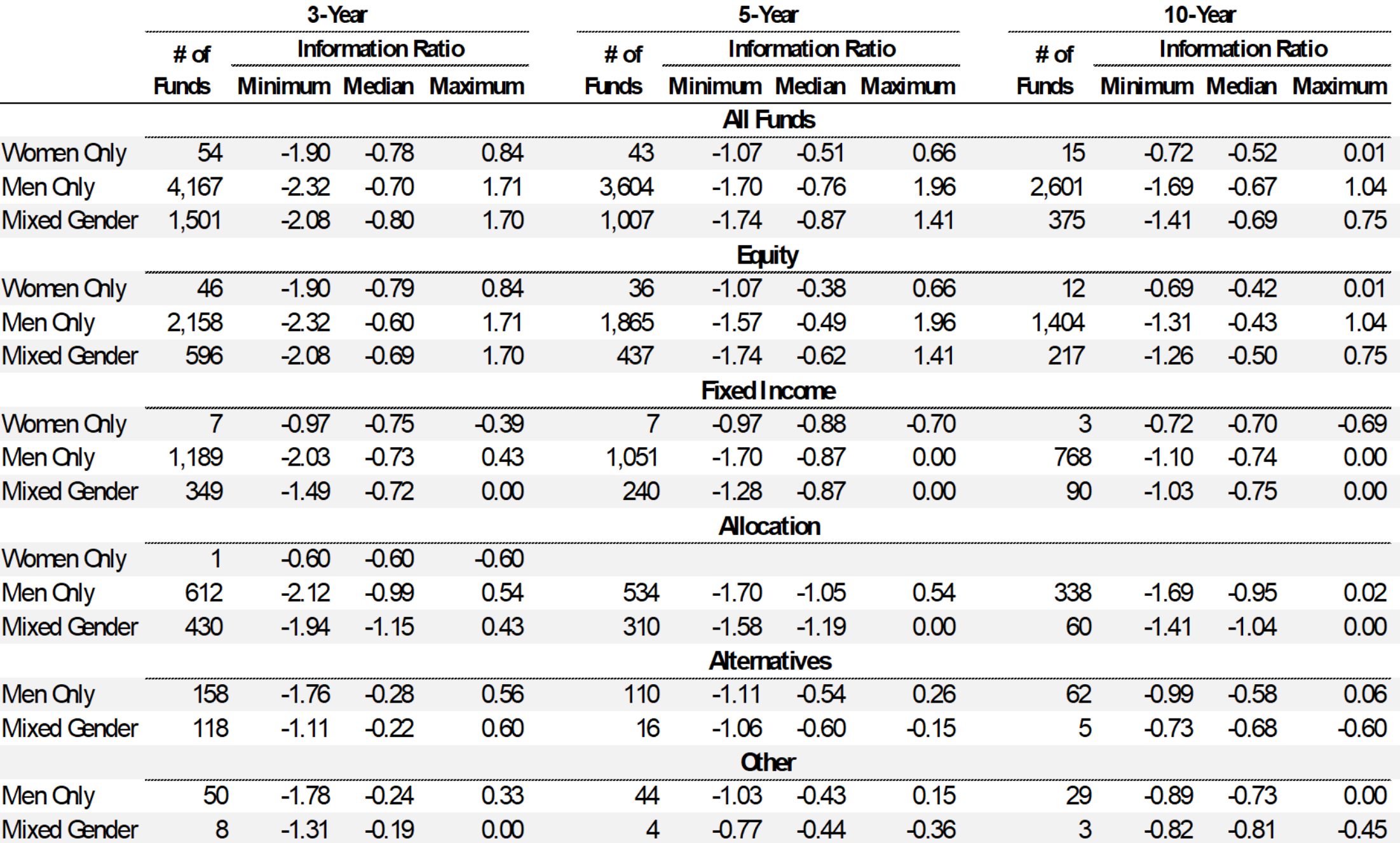

The performance of portfolio management teams, when analyzed by gender composition, shows no clear advantage for women-only, men-only, or mixed-gender teams. Although mixed-gender teams manage a growing share of assets under management—reaching 40% over the past three years—there is no definitive relationship between gender diversity and performance based on key metrics like information ratio or gross returns.

This finding highlights the complexity of measuring diversity’s direct impact on performance. Women-only teams occasionally outperformed men-only teams; however, the small sample sizes make it difficult to draw conclusive findings. Mixed-gender teams generally lagged in shorter time periods, but the median information ratio converged in the 10-year period. More research is needed to explore these dynamics further.

You can’t manage what you can’t measure

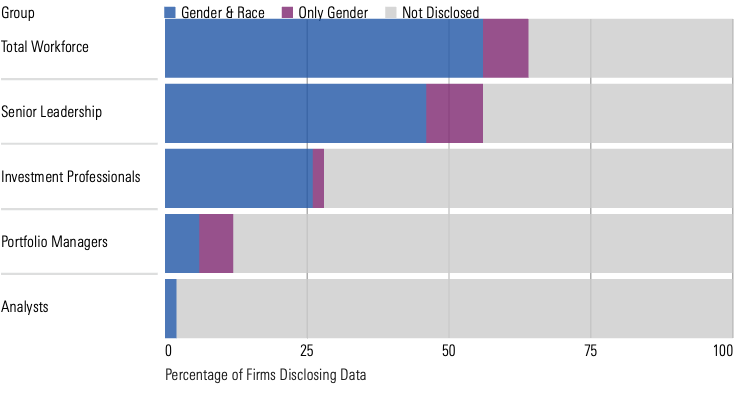

A significant challenge in understanding diversity within asset-management firms is the lack of consistent public disclosures. While 28 of the 50 firms surveyed provided some level of diversity reporting on their websites, the level of detail varied. Few firms disclosed gender, racial, and ethnic representation for investment professionals, and only six firms shared detailed data on portfolio managers and analysts.

Federated Hermes, Natixis, and TIAA’s Nuveen provide portfolio manager gender. Schwab, Pimco, and Vanguard shared more: portfolio manager gender, race, and ethnicity. Vanguard is the only firm that went one step further, providing diversity statistics among its analysts.

The data offers a more-diversified outlook

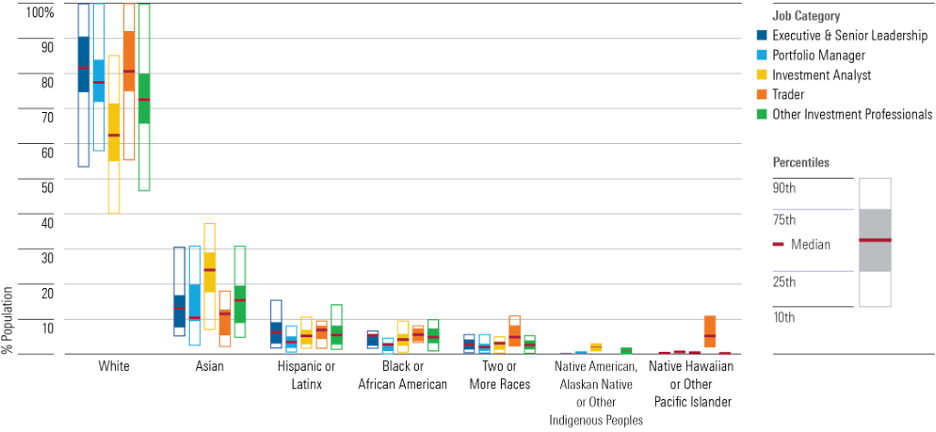

Gender, racial, and ethnic diversity in the executive and senior leadership ranks is largely lacking; white men generally hold these roles. Diversity in investment teams is fascinating. Although women hold 18% of portfolio-manager roles on average, they fill 26% of investment analyst positions. This may indicate greater diversity among portfolio managers and executive and senior leadership in the future, as portfolio managers are often promoted from the investment analyst ranks.

Similarly, non-white professionals make up nearly 40% of investment analyst roles, a higher percentage than in other positions, which could indicate future diversity among portfolio managers and executive and senior leadership.

Morningstar’s survey requested data for a variety of job categories, ranging from executive leadership to trader and client service. Women accounted for less than half of the respondents in each job category except one: administrative support. Here, 80% of employees identified as female on average. With the exception of Asian women, women of all races see their strongest representation in administrative support. Asian women are most likely to hold “other investment” roles. The concentration of minority women in support and back-office roles highlights the ongoing challenge of achieving gender, racial, and ethnic diversity at higher levels of investment management.

While some factors contributing to low levels of diversity in asset management remain outside the control of asset managers, they are not powerless to address the issue. Many firms included in the survey engage their local communities to strengthen a pipeline of diverse talent and partner with a wide variety of organizations that seek to uplift diverse individuals in the industry.

The Morningstar survey highlights both progress and challenges in diversity within asset management. Although no clear link between diversity and financial performance emerges from the data, the growing emphasis on diversity in the industry reflects a broader shift toward more inclusive practices.