4 min read

A guide for comparing real asset investment strategies

A definition of real asset strategies and a straightforward way to compare them in Morningstar Direct.

The latest Consumer Price Index suggests inflation is stabilizing, but rising prices have driven interest in real asset funds as inflation hedges.

Diversified real asset funds invest across stocks and bonds that historically benefit from inflation. These funds saw over $6 billion in net inflows during 2021–22 but have since reversed, with $2.8 billion pulled from early 2023 through May 2024.

In this two-part series, we’ll explore real asset strategies using Morningstar Direct to identify these funds, assess outcomes, and evaluate risks.

What are diversified real asset funds?

Diversified real asset strategies are multi-asset funds that target equities, bonds, and alternatives in industries that are traditionally resilient in the face of rising inflation. We measure inflation by the Consumer Price Index.

Investors turn to real assets as an inflation hedge and diversification opportunity, although market correlations can change over time.

A substantial portion of these funds’ assets should be invested in a combination of inflation-linked bonds, commodities, and equities and fixed-income within these industries:

- Real estate. This sector includes mortgage companies, property management companies, and REITs.

- Energy. Companies that produce or refine oil and gas, oil field services and equipment companies, and pipeline operators. This sector also includes companies engaged in the mining of coal.

- Basic materials. Companies that manufacture chemicals, building materials, and paper products. This sector also includes companies engaged in commodities exploration and processing.

- Utilities, including electric, gas, and water.

- Infrastructure.

- Agriculture.

While real asset strategies capture the desired industry exposures mostly via stocks and bonds, they aren’t expected to hold more than 85% of their net assets in either of those classes. Doing so makes the approach more susceptible to trends affecting the mechanics of those vehicles. The industry exposures are identified by equity economic sector and fixed-income secondary sector data.

Of those sectors, the typical portfolio mixture focuses on basic materials, real estate, utilities, energy, and industrials exposures. Real asset strategies hold a broad combination of these sectors, but the expectation is that no sector exposure goes beyond 50% of a portfolio’s net assets. Any higher, and the portfolio becomes more of a play on a particular industry.

Beyond equities and fixed-income, real asset strategies may use more common inflationary vehicles such as inflation-linked bonds, usually in the form of US Treasury Inflation-Protected Securities, and commodities, normally via derivatives. Again, we wouldn’t expect either of these vehicles to take up more than half of the portfolio’s assets, or it would become more of a TIPS or commodity fund.

Management teams will then balance sector exposures per market expectations and conditions, using the most appropriate vehicles in the process.

How to build a diversified real asset strategy portfolio with Morningstar Direct

Using the new Advanced Search function in Morningstar Direct, users can filter for funds on multiple exposures at once using a range of values. I used this filter to meet the criteria above.

An example of advanced search in Morningstar Direct.

This brings the global fund universe down to roughly 1,300 funds from the tens of thousands. I added the results to an investment list, exported to Excel, and summed up the exposures to US TIPS, commodities, and the relevant equity and fixed-income sectors for an estimate of the total portfolio exposure to real asset industries and related vehicles. I selected portfolios with at least half their assets in the relevant areas.

This results in a list of roughly 45 potentially diversified real asset strategies. Then I reviewed the prospectus language to confirm that these funds intentionally target real asset exposures for the purpose of inflation-driven returns.

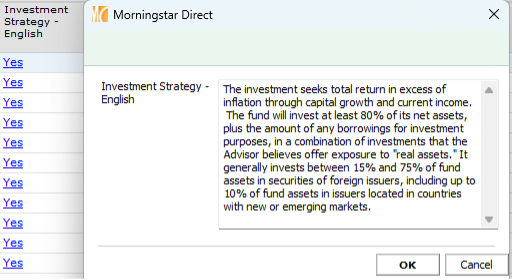

The Investment Strategy data point allows users to see the investment strategy text from the fund’s filings.

Now we can identify funds that fit the characteristics of typical diversified real asset strategies. Below are the 10 largest diversified real asset funds identified in Direct as of June 30, 2024.

- DWS RREEF Real Assets (AAAZX).

- Principal Diversified Real Asset (PDRDX).

- Cohen & Steers Real Assets (RAPIX).

- Wilmington Real Asset (WMRIX).

- Delaware Global Listed Real Assets (DPREX).

- Hartford Real Asset (HRLYX).

- PGIM Real Assets (PUDZX).

- Brookfield Real Assets Securities.

- Lazard Real Assets (RALIX).

- Virtus Duff and Phelps Real Asset (PDPAX).

In the next part of this blog post, we’ll evaluate this group of real assets strategies. Using data in Morningstar Direct, we can explore the flows of the cohort over the last decade and measure the peer group’s track record in generating returns relative to inflationary pressures.