5 min read

How ESMA's New EU Rules are Impacting ESG Portfolios

What are the ESMA guidelines on fund names using ESG or sustainability-related terms?

ESG fund names in the European Union will carry a different and more complex significance than before. Thanks to new guidance from the European Securities and Markets Authority (ESMA), fund managers using environmental, social, or sustainability-related terms in their fund names must now meet strict criteria to keep those labels.

This move is meant to protect investors from greenwashing, the deceptive practice of misrepresenting a product, service, or company as more environmentally friendly than it truly is, but it also brings trade-offs. While the new rules aim to standardize fund disclosures and terminology, they’ve already sparked widespread rebranding and may leave investors unsure of how to interpret what’s in a name.

Under the final guidance issued in May 2024, funds marketed in the EU must follow new requirements if they use ESG-related terms in their names. Managers had until May 21, 2025, to comply.

Download the comprehensive ESMA Guidelines on ESG Fund Names report to see how fund managers are adapting to the new naming rules and how exclusion requirements are reshaping portfolios, backed by insights from Morningstar Sustainalytics’ ESG research.

Here’s what the guidelines entail:

The 80% investment threshold

To qualify, at least 80% of a fund’s investments must align with its stated ESG or sustainability characteristics. Funds using the term “sustainable” must go further, committing to invest meaningfully, defined as more than 50% of the portfolio, in sustainable investments under SFDR Article 2(17).

It’s worth noting that although the ESMA clarified last December that a “meaningful” allocation to sustainable investments should be at least 50%, regulators in some jurisdictions, such as Sweden and Denmark, impose even higher thresholds of 80% and 85%, respectively.

Rebranding trends and the fund manager response

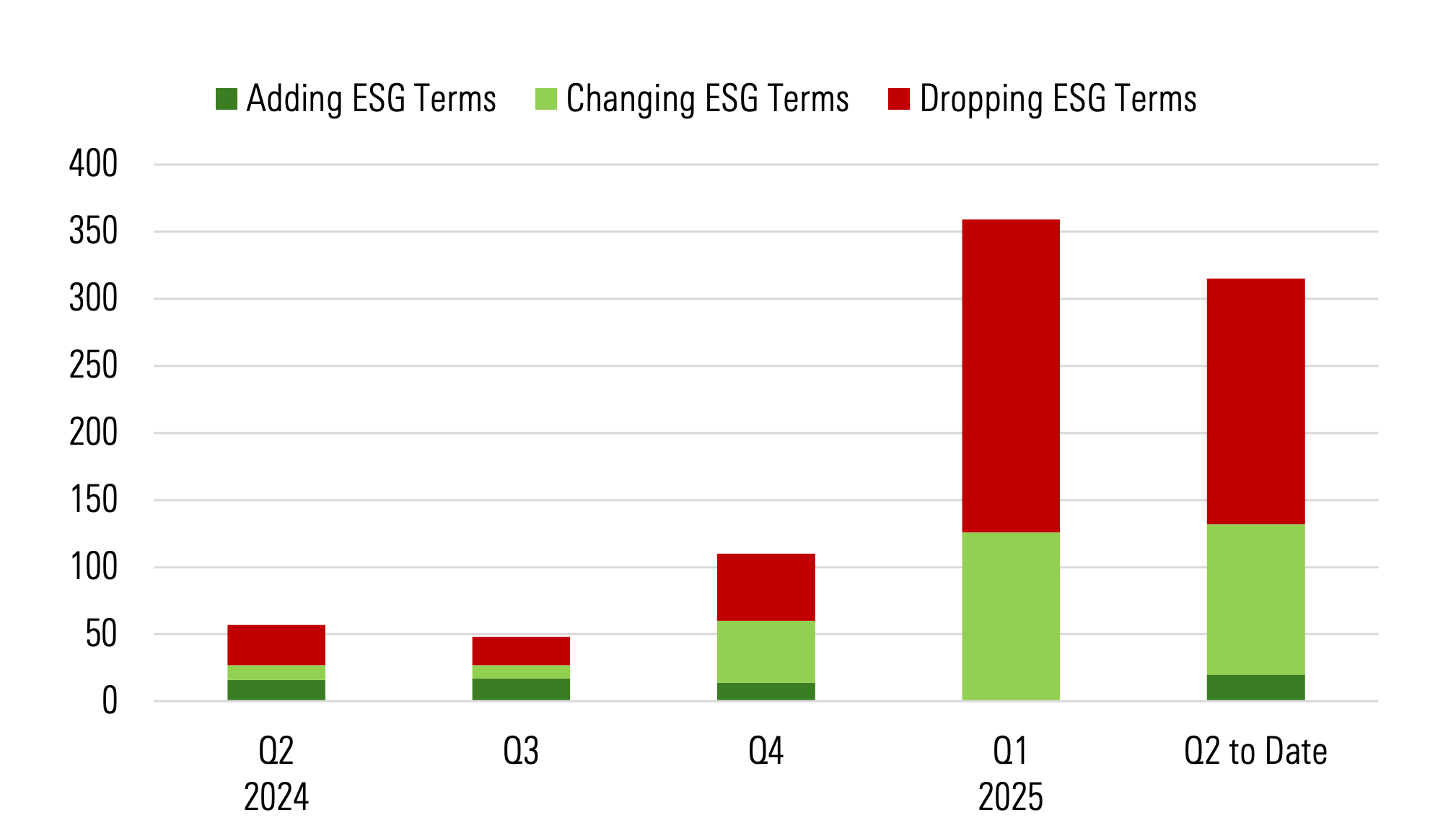

As of mid-May 2025, around 880 funds, or 19% of those in scope, have changed their names. The majority dropped ESG or sustainability-related terms entirely. Others replaced one ESG term with another. Interestingly, a smaller group added more subtle alternative ESG-related language for the first time.

Source: Morningstar Direct. Data as of May 16, 2025. Based on 880 funds that have added, dropped, or changed ESG- and sustainability-related terms in the legal names from May 14, 2024. Including money market funds, funds of funds, and feeder funds.

Terms like “screened,” “transition,” and “committed” are increasingly being used in place of “ESG” or “sustainable.” This suggests managers still want to signal responsible investing characteristics, particularly exclusions, even when they no longer use explicit ESG labels.

Exclusion criteria

Different exclusion criteria apply depending on the language used in a fund’s name. Funds that use environmental, climate, ESG, or sustainable terms must follow the stricter Paris-Aligned Benchmark (PAB) exclusions.

These rules require the fund to exclude companies involved in controversial weapons, tobacco production, and violations of the United Nations Global Compact or the Organization for Economic Co-operation and Development (OECD) guidelines. They must also avoid firms with significant fossil fuel exposure, including those earning more than 1% of revenue from coal or 10% from oil.

Funds using terms like “transition,” “social,” or “governance” follow the Climate Transition Benchmark (CTB) exclusions, which are narrower in scope. These funds still must avoid investments in companies tied to controversial weapons, tobacco, or serious human rights violations, but they may include firms with fossil fuel ties if the strategy supports environmental or social progress. This approach gives transition-focused funds more flexibility to invest in companies working toward meaningful change.

How passive funds and index-trackers have been affected

Passive funds tied to indices most directly connected to ESG benchmarks were disproportionately affected. They made up one-third of all rebranded funds despite accounting for just a fraction of the broader universe. Many managers decided to adjust portfolios while maintaining a focus on exclusions instead of altering strategies entirely.

Index-tracking and ETF funds are not exempt from the new guidelines. Fund managers must ensure that fund names align with the underlying index and still comply with the ESMA thresholds and exclusions.

Combination terms and rules to note

If a fund name combines terms, the strictest requirements apply. For example, a fund named “Sustainable Transition Fund” must apply the PAB exclusions, not the more lenient CTB exclusions.

Funds using the term “sustainable” have dropped sharply. We identified 241 funds that dropped or replaced the term out of the 1,245 that employed the term in May 2024; most of those didn’t meet the 50% threshold.

In contrast, terms like “climate” and “transition” have gained traction. They come with exclusions, too, but can be more flexibly used. Examples of these include Robeco Transition Asian Bonds (formerly known as Robeco Sustainable Asian Bonds). The newly rebranded fund aims to reflect a new emphasis on helping companies improve their environmental performance, not just meeting existing standards.

Still, uptake of “transition” remains limited, partly due to its ambiguity and difficulty proving measurable change over time.

The portfolio impact of ESMA’s exclusions

The guidelines’ exclusion rules focus heavily on fossil fuel-related activities. This has resulted in significant divestments in sectors deemed non-compliant.

Examples of divestments:

- TotalEnergies (France) holdings among ESG funds dropped by 24% between 2024 and 2025.

- Neste (Finland) saw a dramatic 41% decrease in holdings across funds.

The departure from fossil-fuel-heavy stocks raises the question of whether investor values still align with the portfolios of rebranded funds. Varying interpretations of exclusion criteria among fund managers further complicates this landscape, prompting investors to reevaluate their holdings.

While many funds are divesting from companies that no longer meet stricter ESG naming rules, not all decisions are straightforward. One notable exception is Quanta Services, which has seen increased fund ownership despite fossil fuel ties.

Morningstar research found that Quanta, a company involved in utility infrastructure and oil pipeline services, remains a part of several ESG funds. The reason? Its significant role in enabling renewable energy projects may outweigh its fossil fuel exposure in the eyes of some fund managers.

This underscores how ESG implementation remains nuanced even under tighter regulatory standards and how managers are weighing transition potential alongside exclusion rules.

Why PAB/CTB exclusions vary across funds and managers

It’s important to note that PAB and CTB exclusion lists can vary across asset managers and data providers. The scope of exclusions often depends on how certain activities, like transportation or consulting services tied to fossil fuels, are defined and assessed. Because the PAB rules reference broad categories like exploration, extraction, or distribution of fossil fuels, interpretations can differ.

Additional differences may arise from how ownership thresholds or value chain exposure are measured. For example, how far into a company’s value chain should a fund look to assess its ties to controversial sectors? Variability in data sources, methodologies, estimates, and timeliness can also lead to inconsistent application of exclusions.

Use our tools to go deeper

Understanding a fund’s actual alignment with ESG goals and its exclusions is now more critical than ever. Evaluate whether a fund truly aligns with ESMA’s naming guidelines by combining data-driven analysis with direct source review.

Start by checking fund compliance in the Direct Advisory Suite, where you’ll find aggregate insights like SFDR classifications, ESG ratings, and minimum sustainable investment percentages.

Then, validate those insights by reviewing the fund’s prospectus, the primary source for understanding a fund’s ESG policy, investment objectives, and strategy. These documents often contain the clearest explanation of whether the fund meets the thresholds and exclusions required under ESMA’s guidance.

Advisor should:

- Read beyond the fund name: Fund names increasingly reflect compliance rather than broad ESG commitments. Review the portfolio holdings and investment objectives for a comprehensive picture.

Consider fund manager interpretations: The application of exclusion rules varies, meaning fund strategies may differ despite using similar terms.

Evaluate changes in strategy: Rebranded funds may or may not align with your investment goals. For instance, a fund that drops the term “sustainable” might shift focus to purely financial performance.